Everything you need to know about making a Takaful claim

So you have chosen the right Takaful plan for you and started paying the contribution. Later, you fall ill and are admitted to the hospital due to dengue. You are well aware that you can claim your Takaful plan but you are clueless on the process. Let’s find out the type of claims and its processes.

So you have chosen the right Takaful plan for you and started paying the contribution. You really have the peace of mind now, knowing the fact that you are protected against uncertainties that might happen to you. But 2 years down the road, you fall ill and was admitted to the hospital due to dengue. You are well aware that you can claim your Takaful plan but you are clueless on the process.

Have you experienced the above situation? Ever wondered what type of claims you can do and what is the process? Let’s find out.

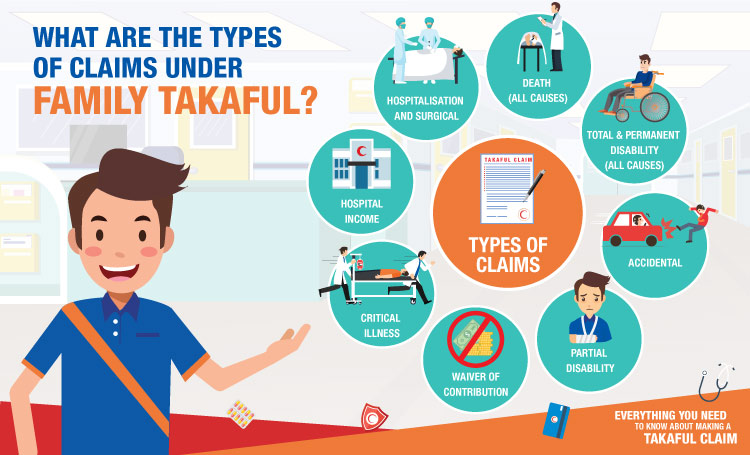

What are the types of claims under Family Takaful?

There are various types of claims that you can do. The above are the most common types of claims under Family Takaful, including but not limited to. Do note that types of claims vary depending on the protection plan you subscribed to.

Under the suicide clause, no claim is payable in the event of death due to suicide, whether sane or insane, within one year from inception of Certificate or from date of any reinstatement.

For full list of exclusions, please refer to your Certificate Document.

How do I submit a claim?

Step 1 : Identify the type of claim.

It is important to first find out the type of claim you want to do to ensure seamless preparation and claim process, as the requirements for each type of claim vary.

Step 2 : Obtain claim form

You may obtain claim form by downloading it from the website or by visiting your nearest branch or Customer Service Centre. Ensure that you obtain the correct form for your claim.

Step 3 : Prepare documents required

Different type of claim requires different documents submission. Visit our website to check documents required for your claim.

Step 4 : Certify your documents

Once all the documents are prepared, you need to get them certified. The following are the authorised personnel who may need to certify your documents:

- Claims/Branch Officer

- Commissioner for Oaths

- Notary Public

- Advocate & Solicitor

- Justice of Peace

- Member of Parliament

- Ketua Balai Polis

- Penghulu

- District Officer

Step 5 : Submit!

Gather all your certified documents and you are set to submit your claim! You may hand in your claim request at your nearest branch, Customer Service Centre or by post.

Why my claim is rejected?

You have got everything prepared and submitted your claim request. You waited for the good news, but you were just informed that your claim request has been rejected. Why? Find out the most common reasons your claim request is denied as shown in the following table:

| Repudiation | Solution |

|---|---|

| Material non-disclosure | Ensure that you make full disclosure in your proposal form |

| Certificate not inforce | Make contribution payment accordingly to ensure your Certificate is inforce |

| Lapsed after grace period (usually in the first three years of inception) | |

| Expired due to cash value exhaustion | Ensure you have sufficient cash value in your Individual or Unit Account. Seek assistance from your Takaful Advisor |

| Hospitalisation or Covered Event took place within waiting period | Claim can only be made if the incident happen after waiting period or after commencement date |

| Event occurred before certificate commencement date | |

| Event falls under an excluded risk | Read full exclusion list in your Certificate document |

| Hospitalisation due to alcoholism or substance abuse | No protection plan provides coverage involving substance abuse or alcohol usage. |

| Event not within scope of coverage | Understand the benefits that the plan provided. Find out your plan’s scope of coverage in the Certificate document |

| No hospital admission, only outpatient treatment | Medical plan usually cover inpatient treatment |

| Condition due to illness and not accident | Your protection plan may not cover illnesses. Kindly subscribe to our Critical illness plan here |

| Disability or illness does not meet Certificate definitions or terms and conditions | Read the terms and conditions and the fineprint of your plan in the Certificate document |

| Incomplete documentations | Ensure all documentations required are provided and certified accordingly. Check the required documents for your claim here |

Requesting a Takaful claim should be a swift process if you know and understand the requirements. Follow the guidelines provided to ensure that you have everything in order before submitting your claims to avoid prolonged claim process.

You can also ask assistance from our Customer Service or your servicing Takaful Advisor for further clarifications.

Click here for claims FAQ.