Planning your financials with a high income protection plans

Wonder what an income protection plan is? Learn how to protect your income with this plan & its benefits to ensure your future financial stability. Read here!

As your profession evolves, your financial planning too needs change. If you are a corporate executive or in an upper management position, not only are you highly compensated, but you often have access to a different set of fringe benefits. And if you are a business owner, you are exposed to bigger financial risks as you have a lot more in your plate to protect without the corporate benefits.

The more you make, the more you will need to protect your financial or business to be able to maintain your lifestyle throughout retirement or for your family survival in the event of your passing. Find out when and how will you benefit from a high protection plan.

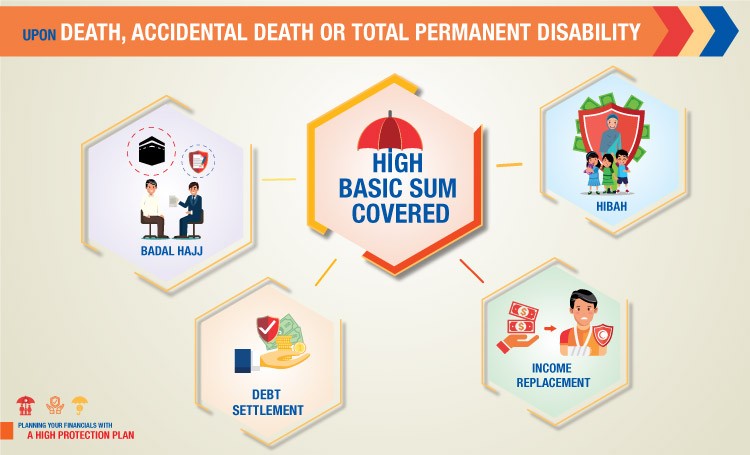

In the event of your passing due to natural or accidental cause, or if you are inflicted with Total Permanent Disability, you may utilise your high Basic Sum Covered for the following purposes:

- Hibah the sum covered amount to your next-of-kin or family members for their survival. This will ensure that they will continue to maintain the lifestyle they had before your passing.

- as income replacement should the unforeseen circumstances happen to you. It can be used for you and your family survival during your recuperation.

- to help settle large financial commitments such as financings so that your family is not financially burdened.

- to ensure your Hajj obligation is fulfilled by an able organisation through Hajj Proxy Service in the event of your passing or disability.

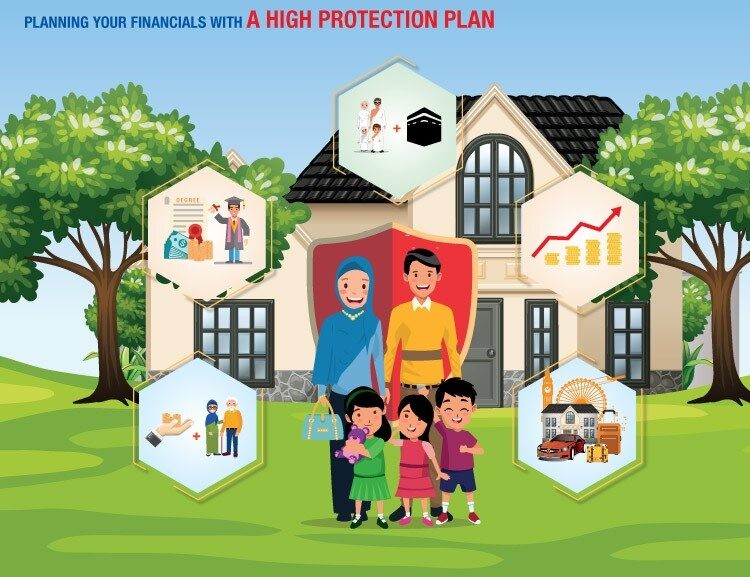

Should you survive until the end of your Certificate maturity, your maturity benefit can be used for the following purposes:

- as your retirement fund to continue your life journey post-working life.

- to perform Hajj / umrah with your spouse or family.

- to ensure your children's fund is adequate to support their tertiary education or to help them start living independently.

- to fulfil your life dreams be it travelling the world, start own business or pursue your unique passion or hobbies.

- to leave a legacy to your next generation as a gift of love.

- reinvest a portion of the money to grow your savings.

There are many ways you could benefited from getting a high protection plan, not only for you, but for your family you might leave behind if something untoward happens to you. For more information on Takaful plan with high Basic Sum Covered, please click here.