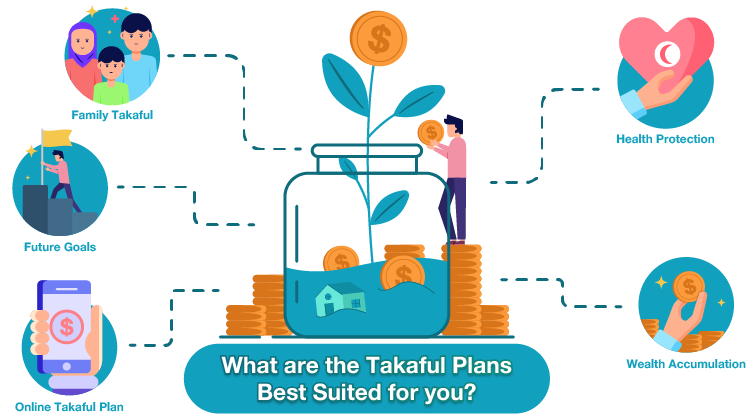

What are the Takaful plans best suited for you?

With the range of takaful plans we have to offer you, rest assured our different benefits are able to suit how you would like to protect yourself as well as your loved ones. Here we have a list of our types of takaful plans in Malaysia as well as how they best benefit you.

With the range of takaful plans we have to offer you, rest assured our different benefits are able to suit how you would like to protect yourself as well as your loved ones. Here we have a list of our types of takaful plans in Malaysia as well as how they best benefit you.

List of plans

1. Family Takaful

What this type of takaful coverage provides is financial protection to individuals and their families in the event of illness, disability, or death. Great Eastern Takaful provides a variety of solutions that give you and your family the most suitable takaful coverage for different needs. You can view our Family Takaful catalogue and choose the one that works best for your family. The catalogue consists of plans such as a takaful protection plan for infectious diseases, a takaful savings plan, and a comprehensive takaful plan.

Great Eastern Takaful Berhad also offers a savings and investment plan. It is a regular contribution, non-participating, and investment-linked plan designed to help individuals save and invest for their future.

A common question regarding this is “what exactly is the difference between general takaful and family takaful?” The comparison between these two takaful plans is that while family takaful provides a combination of long-term savings and protection for certificate holders and their dependents, general takaful focuses on a short-term protection of properties and liabilities against any loss or damage.

2. Health Protection

This type of takaful coverage provides protection against the high costs of medical treatments and hospitalisation. It includes coverage for inpatient and outpatient treatments, surgery, and emergency medical care. Our healthcare plans can assist the recuperation process by getting you the treatment that you need. With the right takaful plan, you’ll always be prepared for anything that might happen, making you more secure, both financially and health-wise. Some of Great Eastern Takaful’s health care plans can be found here.

3. Future Goals

This takaful coverage aims to allow you to travel, gain more assets, continue developing yourself by receiving more education or even to have financial security when the time comes for retirement.

At Great Eastern Takaful, we have a plan called Future Goals for making your goals achievable which consist of a plan that protects and fulfil your life aspirations.

4. Wealth Accumulation

In the event of a personal accident, medical condition, death, or any unexpected misfortune, your definite investment plans can be derailed which is why choosing the right takaful plan is important. To protect you against any unforeseen events, our wealth protection universal takaful savings plans also provides death benefit payout and critical illness benefit to ensure you and your family are adequately covered.

5. Online Takaful Plan

Applying for a comprehensive protection plan can be rather tedious. This is why Great Eastern Takaful takes the initiative to provide you with takaful plans via online. This way, everyone will have access to get the best protection plans Great Eastern Takaful could offer.

There are three takaful online protection plans that you can choose from here.

Benefits of Takaful

There are several benefits to takaful. Among them is the economic benefit. As Takaful products include a savings and investment component, they are helpful in providing early preparation to certificate holders. Because Takaful is shariah compliant, it is a popular instrument for savings compared to conventional insurance. Even non-Muslims can purchase this coverage. It is unlike conventional insurance. Any extra profit goes to the shareholders.

Besides that, it is interest-free as Takaful is aimed at achieving cooperation among participants. It also provides a certain amount of cashback for certain products if no claims are made. Another important benefit would be that the fundamental concept of Takaful is cooperation where it provides financial assistance as well as other benefits such as profit sharing, tax relief and Badal hajj/waqf services. The Takaful system benefits everyone no matter what.

Takaful offers a wide range of coverage options, as well as investment options that allow certificate holders to grow their money in a socially responsible way. Learn more with Great Eastern Takaful Berhad today!