Key benefits

-

Infectious Disease Coverage

In the event of the Person Covered being diagnosed with any of any of the 4 listed Mosquito-Borne Infectious Diseases (Dengue Hemorrhagic Fever, Malaria, Yellow Fever, and MERS-COV), Infectious Disease Benefit of RM5,000 is payable once Person Covered from the Tabarru' Fund. Waiting Period of 90 days applies.

-

Death due to Mosquito-Borne Disease

In the event of death within 30 days of the definite diagnosis of any of the Mosquito-Borne Diseases (Dengue Fever, Malaria, Chikungunya, Japanese Encephalitis and Zika virus), additional 100% of Basic Sum Covered will be payable on top of the Death Benefit payable.

-

Accidental Death Benefit up to 4x Sum Covered

In addition to the Death Benefit, your next of kin will receive up to 300% of the Basic Sum Covered. Please refer to the product brochure for further details if the accident happens outside of Malaysia.

-

Critical Illness Plan Benefit

In the event of the Person Covered being diagnosed with any one of the 5 listed Critical Illnesses (Cancer, Heart Attack, Coronary, Stroke and Kidney Failure), 50% of Basic Sum Covered will be payable from Tabarru' Fund.

-

No Medical Underwriting

Get this infectious diseases protection plan without having to go through the hassle of medical underwriting.

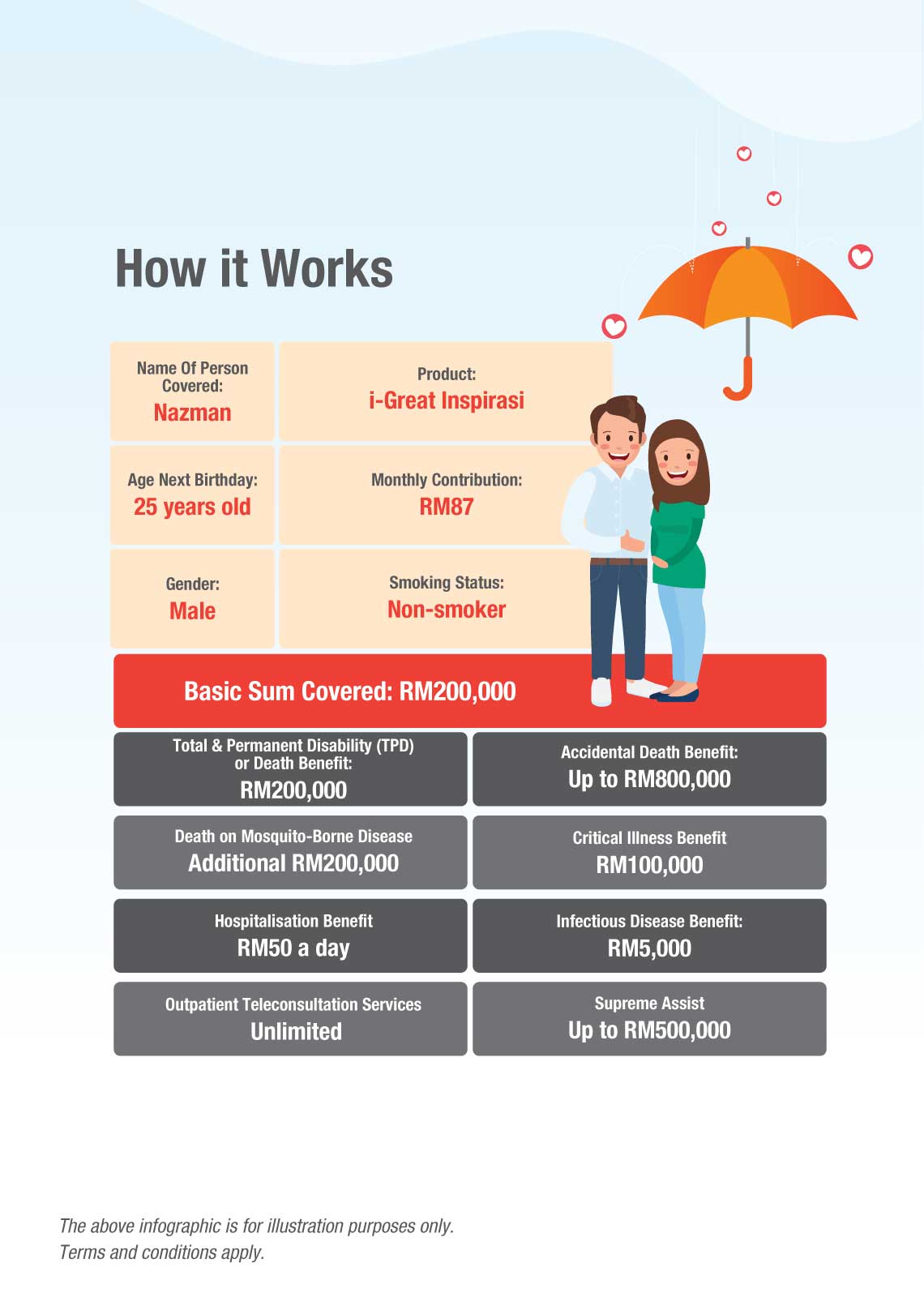

How i-Great Inspirasi works

Let us match you with a qualified Takaful advisor

Our Takaful advisor will answer any questions you may have about our products and planning.

How can we help you?

Understand the details before participating

- i-Great Inspirasi is a regular contribution Family Takaful Term Plan that matures up to age 85 years next birthday with the benefit of family takaful protection.

- Contributions are payable until the end of your coverage term or death or TPD, whichever occurs first. Contribution for this plan is a step-up contribution where it may increase based on attained age next birthday of the Person Covered on the first day of every certificate anniversary.

- You should be convinced that this plan will best serve your needs and that the contributions payable under the certificate are affordable to you.

- A “free-look period” of 15 days from the delivery date of the certificate is given for you to review the suitability of the plan. If the certificate is returned to us during this period, we shall refund an amount equal to the amount of contributions paid minus medical expenses (if any).

- Participating in a family takaful plan is a long-term financial commitment. If you do not pay your contributions within the grace period of 30 days, your Certificate will lapse. Upon surrender, the following will be refunded:

- The unearned Unallocated Contribution (other than the first year Unallocated Contribution) less actual expenses incurred will be refunded; and

- The unexpired Tabarru from the Tabarru Fund will be refunded.

- Upon termination or maturity or expiry, no benefit will be payable from Tabarru' Fund.

- If you switch your certificate from one Takaful Operator to another or if you replace your current Certificate with another Certificate within the same Takaful Operator, you may be required to submit an application where the acceptance of your proposal will be subject to the terms and conditions to be imposed at the time of switching. or replacement.

This information merely provides general information only and is not a contract of Family Takaful. You are advised to refer to the Benefit Illustration, Product Disclosure Sheet and sample Certificate for detailed features and benefits of the plan before participating in the plan.

Great Eastern Takaful Berhad is a member of PIDM. The benefit(s) payable under eligible certificate/product is(are) protected by PIDM up to limits. Please refer to PIDM’s TIPS Brochure or contact Great Eastern Takaful Berhad or PIDM (visit www.pidm.gov.my).