4 benefits of hibah Takaful

Bank Negara's Shariah Advisory Council (SAC) issued a resolution that hibah in takaful can be granted, many takaful participants have breathed a sigh of relief. Find out what that means and the benefits of hibah takaful.

Since Bank Negara's Shariah Advisory Council (SAC) issued a resolution that hibah in takaful can be granted on 5 November 2014, many takaful participants have breathed a sigh of relief. This means that any death benefit can be given directly to the nominee without having to go through the estate management process.

However, almost 7 years since the resolution from the SAC was announced, many are still wondering, “Hibah takaful? What is that? What are the benefits and its advantages? ” We always hear the word hibah but don't really understand what it means.

Hibah means the giving of ownership of an item to a person without any return, in other words, hibah also means a gift given by a person to another person voluntarily while he/she is still alive. This means that if you as a takaful contributor passed away, the nominee appointed by you will receive absolute compensation for the benefits of the takaful plan you have participated.

What are the benefits and advantages of hibah takaful? Why do we need to hibah in takaful? Here are the 4 benefits of hibah takaful:

Income replacement

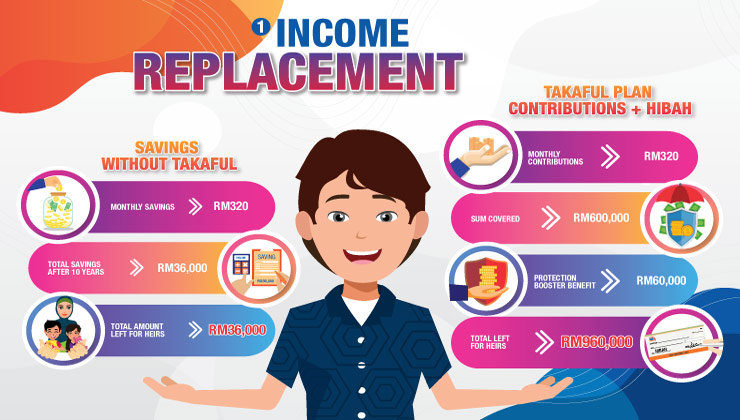

Everyone will face death and every such death is different. The passing of a major breadwinner for the family is a more painful loss and leaves a huge impact on other family members. This sudden loss not only brings grief, it also results in the loss of all sources of livelihood and monthly alimony for the family left behind. Expenses for wife, children and parents will cease. The wife who was once a housewife may have to find work to support the family, the children will also have to be frugal and fast for survival.

This is where hibah takaful plays an important role in ensuring that the heirs you leave behind can continue living comfortably. See the example below for a clearer picture:

| Savings Without Takaful | Takaful Plan Contributions + Hibah | ||

|---|---|---|---|

| Name | Emran | ||

| Age | 30 years old | ||

| Smoking Status | Non-smoker | ||

| Monthly Savings | RM320 | Monthly Contributions | RM320 |

| Total in 10 Years | RM38,400 | Sum Covered | RM600,000 |

| Additional Benefits | - | Protection Booster | RM60,000 |

| Total Left to Heirs | RM38,400 | Total Left to Heirs | RM960,000 |

Terms & conditions apply. Click here for more info.

See the difference in the amount you can afford to leave to your heirs. With the same amount every month for 10 years, you can afford to double the amounts for your heirs, subject to the benefits of the takaful plan offered by the Takaful Operator in Malaysia. Although money cannot replace the loss of a loved ones, but those left behind need financial help to get on with life. With hibah takaful given to your spouse, your family members can live a normal life without being burdened with financial problems.

Want to know the amount of hibah you need? This is the formula:

Single: [Monthly income x 12] x 3 years = Hibah amount

Married: [Monthly income x 12] x 10 years = Hibah amount

Debt settlement

Islam strongly demands the settlement of debts in life even after death. The Prophet SAW said, “All the sins of the martyrs are forgiven except debt” (Hadith narrated by Muslim). The religious scholars and ustaz have also advised that debt is the main thing that needs to be resolved by the heirs immediately after the death of a person and his body is taken care of. Even the heirs are obliged to settle the debts of the deceased first before managing and distributing his property to the heirs.

In the Hadith narrated by Bukhari and Tirmizi: “Indeed, the soul of the Believer is hanging due to his debt. Until the debt is paid”.

If you owe your friends RM100-RM200, maybe your heirs can pay it off. But what about larger debt commitments like business debt, personal financing worth thousands of ringgit? Of course it burdens your heirs not only financially, but their emotions are also disturbed by the debt left behind.

Therefore, hibah takaful is the best way to ensure that your ‘departure’ does not complicate and burden them. With that, they can use the money that you have left to pay off all your debts and get on with life as usual.

Absolute recipient & hassle-free process

In contrast to a will and division of an estate, a hibah is the unquestionable giving of a gift by a person to his/her heirs. This means that the recipient of the hibah is the absolute owner of the ‘gift’, whether in the form of cash or property after the death of the owner. This can of course avoid quarrels between family members, as the nomination for the takaful is done by the participant while he is still alive and sane, voluntarily.

Apart from that, the hibah takaful claim process is also very easy and fast without involving any additional costs. When you lost someone, the last thing you want to do is to go through the hassle of claiming your rights. Don’t worry, compared to a will, hibah doesn’t require the heirs to hire a lawyer or appoint a third party to manage it. Since hibah is a gift, the value will be given 100% to the recipient without any deduction. There are also Takaful Operators who provide additional cash benefits to beneficiaries such as compassionate benefit of RM2,000 in the event of the participant's death.

In addition, hibah takaful can also be categorised as a liquid asset, so the claim process is easier and faster which can be processed within a month. Imagine if your heir was a housewife with no source of income, where would she get quick financial assistance to get on with life? How much can be borrowed from family members or friends? With the hibah takaful, your heir can use the money left for daily living expenses and adjust their lives without you before looking for other sources of income.

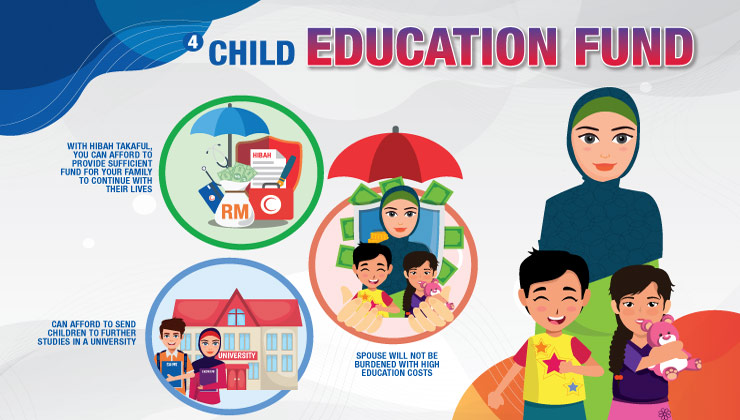

Child education fund

Children are our next generation and our most valuable asset in this world and the hereafter. It is our responsibility as parents to provide the best education for our children for their bright future. We certainly want them to learn comfortably in school, and providing the opportunity to further their studies to a higher level at a reputable university. However, the rising costs of education every year makes it difficult for parents to provide sufficient expenses to cover the cost of their children's education.

Furthering studies at a local university alone will cost tens of thousands of ringgit, let alone at a foreign university. You certainly don't want your dreams to go unfulfilled and disappoint your children because they can't afford to further their studies , right?

With hibah takaful, you are able to provide enough funds for your children to further their education even if you are no longer with them. Plan your finances as best you can. The earlier you contribute takaful and hibah to your heirs, the lower the monthly contribution and the more secure the future of your children. They would be definitely grateful and happy that you have planned a bright future for them.

In conclusion, hibah takaful plays a very important role in protecting our heirs when they lose a family member, especially if the deceased is the sole breadwinner in the family. If you have not appointed a nominee for your takaful plan, do so immediately. Make sure the nominee is the recipient of the hibah and not the executor, because the executor is not the absolute recipient, the benefits still need to be distributed according to estate management laws. If you have not yet subscribed to a takaful plan and want to hibah to your beneficiaries, visit the various takaful plans we offer that suit you.