Key benefits

-

61 critical illness coverage for child and adult in one plan

Enjoy the widest critical illness coverage for child and adult under one single plan. Please see the list of 61 critical illnesses here.

-

2 options of claims payout

Get ADDITIONAL claim payout on top of the basic plan's Sum Covered. Hence, your basic coverage will still continue to be in force.

-

Coverage of up to 5x Basic Sum Covered

Protect yourself, spouse and beloved children against critical illness and receive coverage of up to 5 times Basic Sum Covered or RM5 million!

Benefits at a glance

i-Additional Lifetime Critical Illness Term Rider

i-Additional Lifetime Critical Illness Term Rider

- Coverage of up to 5 times Basic Sum Covered or RM5 million

- Coverage against 11 Child Specific Critical Illness and 50 Adult Critical Illness

- ADDITIONAL claim payout on top of the basic plan Sum Covered. Hence, your basic coverage will still continue to be in force.

i-Lifetime Critical Illness Term Rider

i-Lifetime Critical Illness Term Rider

- Coverage up to Basic Sum Covered or RM5 million, whichever is lower

- Coverage against 11 Child Specific Critical Illness and 50 Adult Critical Illness

- The claim payout will REDUCE the Sum Covered of the Basic Plan

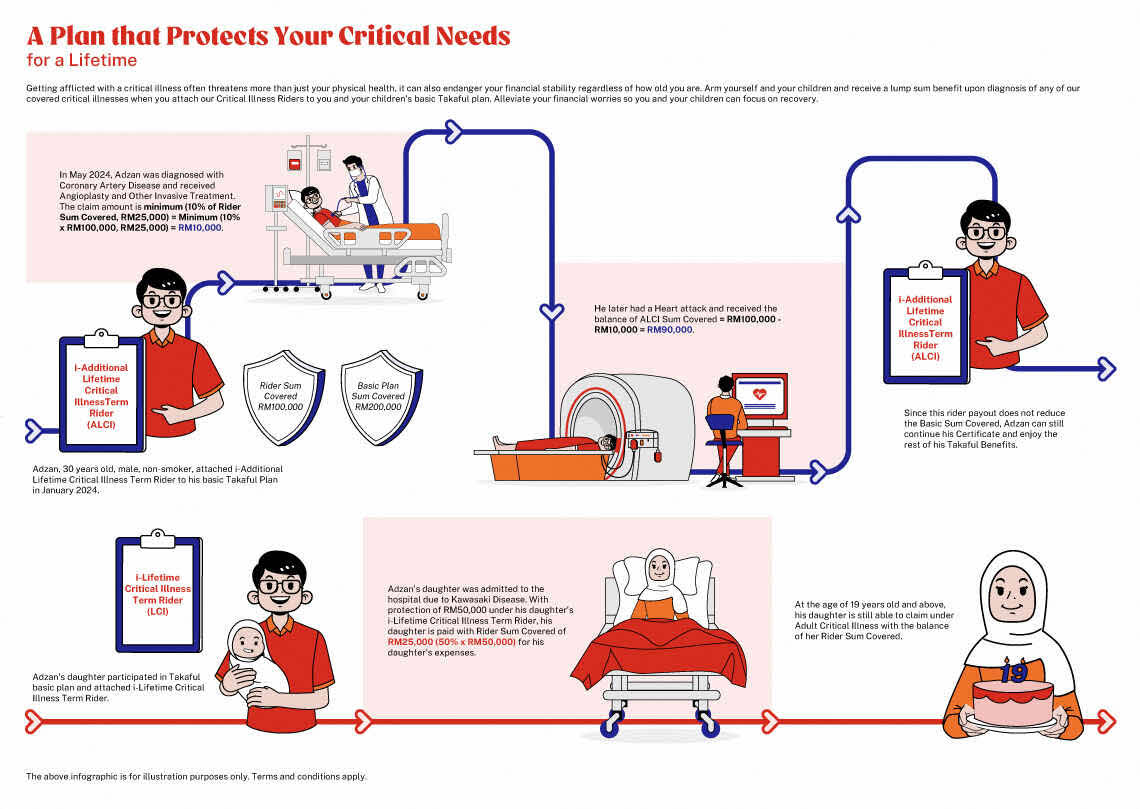

How i-Additional Lifetime & i-Lifetime Critical Illness Term Rider works

Let us match you with a qualified Takaful advisor

Our Takaful advisor will answer any questions you may have about our products and planning.

How can we help you?

Understand the details before participating

- i-Additional Lifetime Critical Illness Term Rider and i-Lifetime Critical Illness Term Rider are regular contribution paying Medical and Health Takaful riders attachable to selected regular contribution Term Family Takaful Plans that provide coverage in the event of Critical Illness.

- Both i-Additional Lifetime Critical Illness Term Rider and i-Lifetime Critical Illness Term Rider can be attached together or singly.

- Age refers to age next birthday.

- You should satisfy yourself that these riders will best serve your needs and that the contribution payable until the end of the certificate term is an amount you can afford.

- You may stop paying contributions and still enjoy protection as long as there are sufficient amount of money in the Participant’s Individual Account to pay for the Tabarru’, where applicable. However, there is a possibility of certificate lapsing when the required charges, including Tabarru’, exceed the money available in Participant’s Individual Account. Participating in too many riders or choosing high protection levels may deplete the cash values. Depending on the fund's performance, the Participant's Individual Account value may decrease and the certificate may potentially lapse.

- When riders are terminated or laid-off or upon rider expiry date, no benefit will be paid from the Tabarru Fund.

- A “Free-Look Period” of 15 days from the delivery date of the certificate is given for you to review the suitability of these Medical and Health Takaful riders. If the certificate is returned to us during this period, we shall refund an amount equal to the amount of contributions paid minus medical expenses (if any).

- If you switch your rider from one Takaful Operator to another or if you exchange your rider with basic plan, or vice versa, within the same Takaful Operator, you may be required to submit an application where the acceptance of your proposal will be subject to the terms and conditions to be imposed at the time of switching or replacement.

Terms and conditions apply. The info above merely provides general information only and is not a contract of family takaful. You are advised to refer to the benefit illustration, Product Disclosure Sheet and sample certificate for detailed features and benefits of the plan before participating in the plan. You may also refer to the consumer education booklet on Medical & Health Takaful issued under the Consumer Education Programme for more information.

Great Eastern Takaful Berhad is a member of PIDM. The benefit(s) payable under eligible certificate/product is (are) protected by PIDM up to limits. Please refer to PIDM’s TIPS Brochure or contact Great Eastern Takaful Berhad or PIDM (visit www.pidm.gov.my).