Key benefits

-

Guaranteed acceptance

Get this plan without any hassle going through the underwriting process. Take this golden opportunity so that you can protect yourself from any misfortune.

-

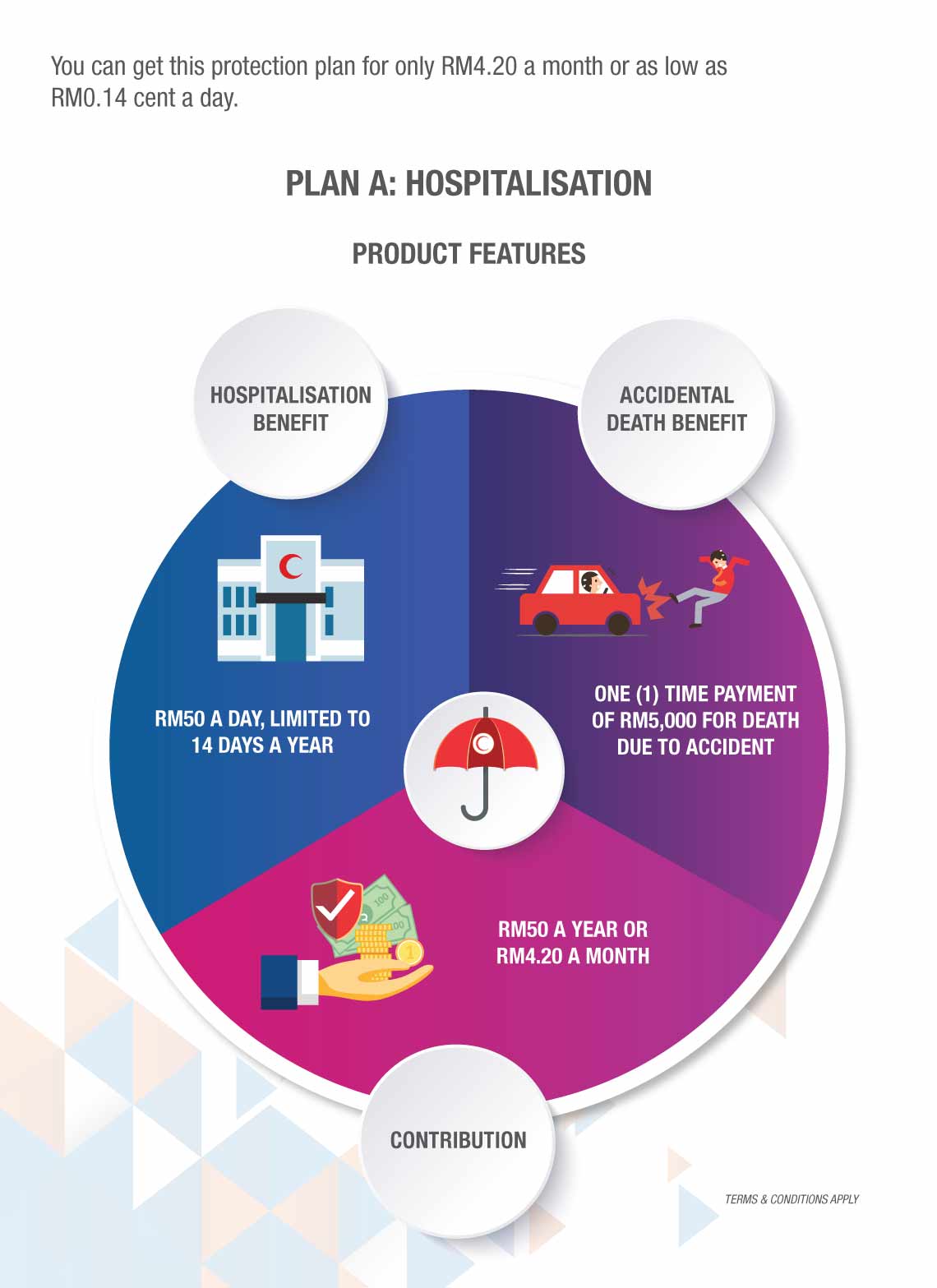

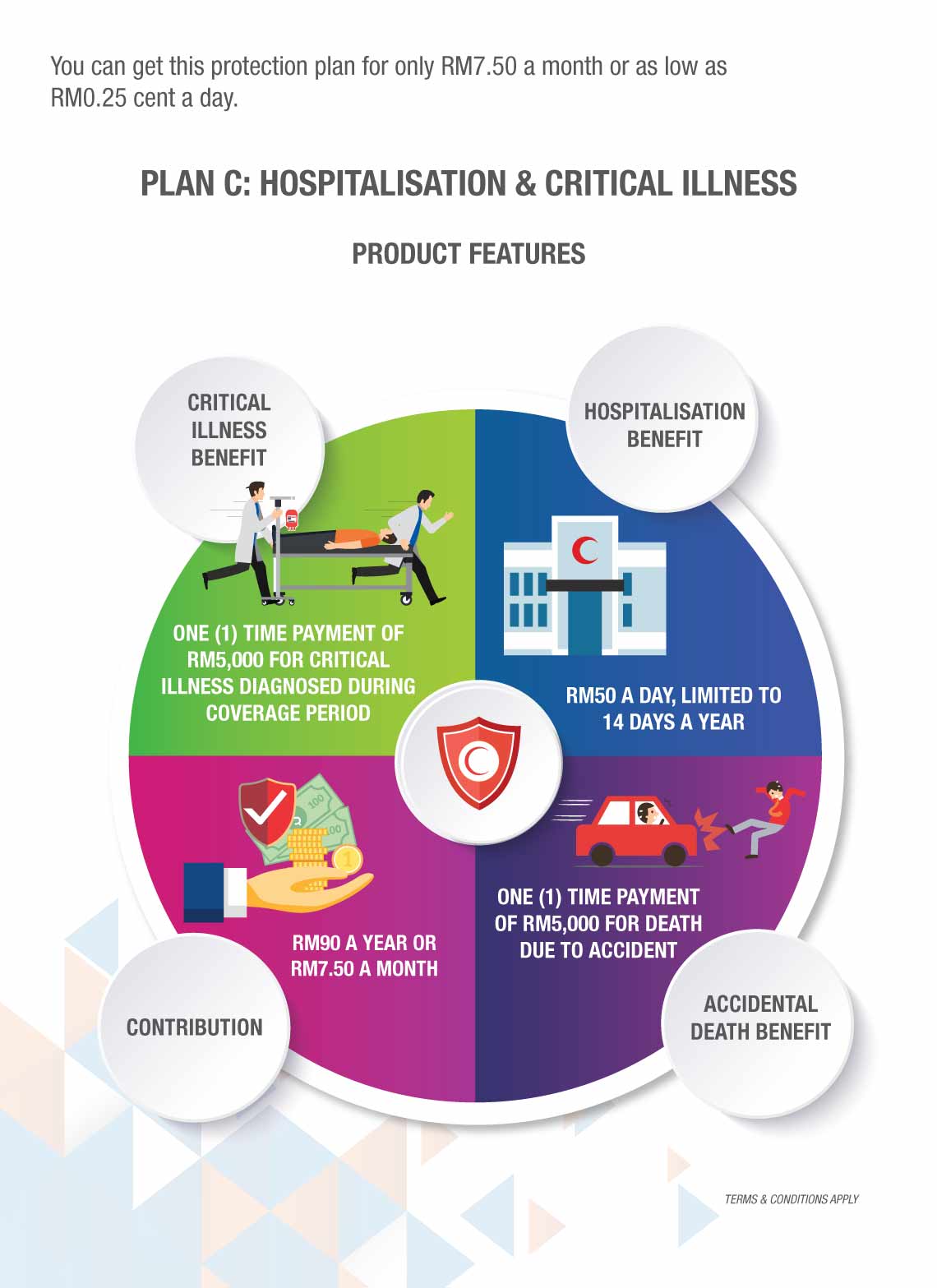

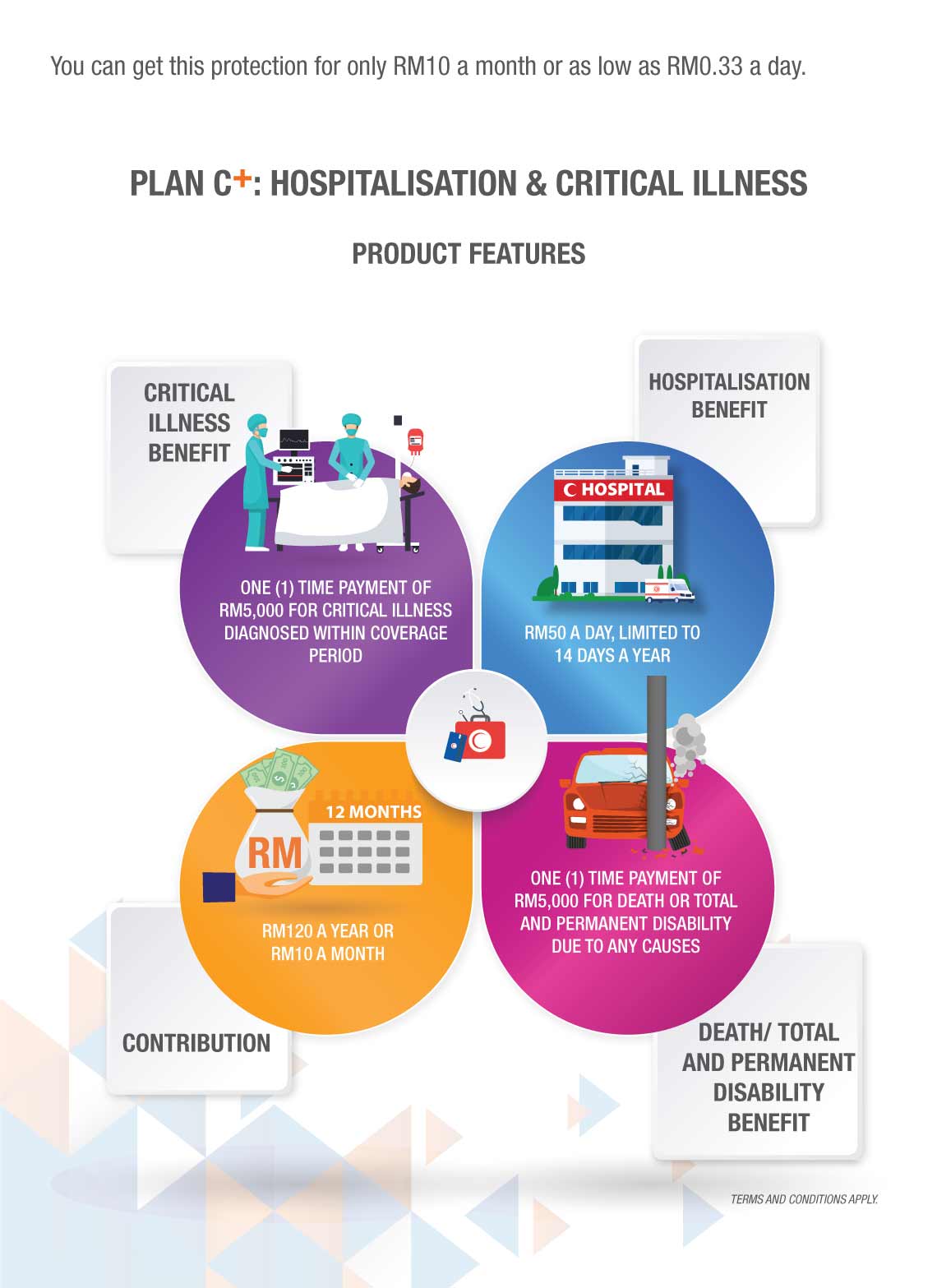

Hospitalisation Benefit of RM50 a day

If the Covered Person is hospitalised, the Person Covered will receive an allowance of RM50 a day, limited to 14 days per year.

-

Accidental Death Benefit of RM5,000

In the event of the death of the Person Covered due to an accident, the next of kin will receive a lump sum payment of RM5,000 to reduce the burden due to the loss of a loved one.

-

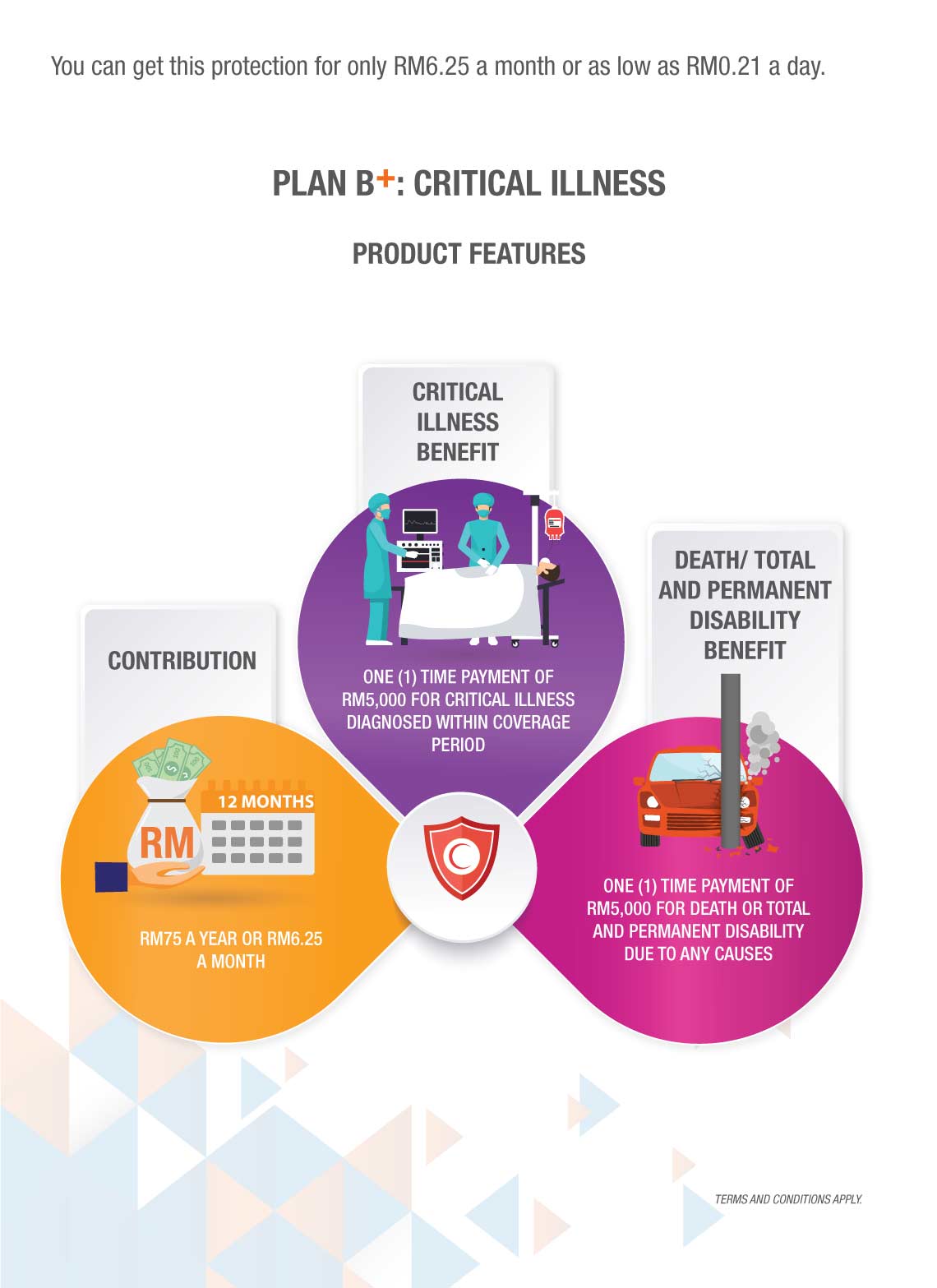

Critical Illness Benefit of RM5,000

The Person Covered is entitled to a lump sum payment of RM5,000 if diagnosed with a critical illness during the coverage period.

How MikroSayang works

Let us match you with a qualified Takaful advisor

Our Takaful advisor will answer any questions you may have about our products and planning.

How can we help you?

Understand the details before participating

Great Eastern Takaful Berhad (916257-H) is licensed under the Islamic Financial Services Act 2013 and is regulated by Bank Negara Malaysia. No intermediaries are involved in the promotion or marketing of products offered through direct channel.

1. MikroSayang is a yearly renewable Group Term Takaful plan that provides coverage to the Person Covered upon occurrence of the following events. This is a Family Takaful product, not an investment product such as unit trust and does not have any savings or investment element.

• Death/Total and Permanent Disability Benefit: death or Total and Permanent Disability (subject to Total and Permanent Disability Continuation Period) of the Person Covered during the coverage period,

• Accidental Death Benefit: death of the Person Covered due to Accidental causes during the coverage period, and/or

• Hospitalisation Benefit: hospitalisation of the Person Covered in a Panel Hospital during the coverage period, and/or

• Critical Illness Benefit: Critical Illness of the Person Covered during the coverage period.

Note: Total and Permanent Disability Continuation Period refers to Total and Permanent Disability which has continued for at least 6 consecutive months from the disability date while the certificate is inforced.

2. Benefits as specified above are subject to the following Waiting Period:

• The eligibility for Death/Total and Permanent Disability Benefit will only start 30 days after the effective date for death/Total and Permanent Disability due to non-accidental causes.

• The eligibility for Hospitalisation Benefit will only start 30 days after the effective date for hospitalisation due to non-accidental causes.

• The eligibility for Critical Illness Benefit will only start 30 days or 60 days (depending on the type of Critical Illness) after the effective date.

Note: The Waiting Period shall not be re-applied upon renewal of the same plan or upon participation of a different plan with the same benefit. For participation in a new plan with a different benefit which was not applicable in the previous plan participated, a fresh Waiting Period for that benefit will be applicable.

3. Age refers to Age Next Birthday (ANB).

4. Contributions must be paid towards the end of coverage period or until Person Covered passes away, whichever earlier. Should there be no contributions paid within 30 days waiting period, your certificate will be forfeited.

5. The Takaful certificate will be terminated and no benefit will be payable from the Tabarru’ Fund upon:

i. Death of the Person Covered, whether the Accidental Death Benefit is paid or not;

ii. Total and Permanent Disability for Person Covered;

iii. Cancellation or surrender of the Takaful Certificate, or

iv. Termination of the Master certificate.

6. You should be confident that this plan will best meet your needs and contributions paid under this certificate is the amount you can afford.

7. “Free Look Period” for 15 days after you have received Registration confirmation E-mail and a certificate provided to you to examine plan suitability. If the certificate is returned to us within this period, we will refund you with the amount equivalent to total contribution paid.

8. Written notice of at least thirty (30) days in advance will be given (“Notice Period”) to the Person Covered if there are any changes towards the contribution, Upfront Charge and/or Tabarru’ Rate (“Rates and Charges”). Contribution and charges are not guaranteed and may change on certificate renewal date.

9. Any changes to benefits structure are subject to review by us on certificate renewal date with at least 30 days of written notice.

This information merely provides general information only and is not a contract of Group Term Takaful. You are advised to refer to the Product Disclosure Sheet and sample certificate for detailed features and benefits of the plan before participating in the plan. You may also refer to the consumer education booklet on Medical & Health Takaful issued under the Consumer Education Programme for more information.

MikroSayang is a Shariah-compliant product.

Great Eastern Takaful Berhad is a member of PIDM. The benefit(s) payable under eligible certificate/product is (are) protected by Perbadanan Insurans Deposit Malaysia (PIDM) up to limits. Please refer to PIDM’s Takaful and Insurance Benefits Protection System (TIPS) Brochure or contact Great Eastern Takaful Berhad or PIDM (visit www.pidm.gov.my).