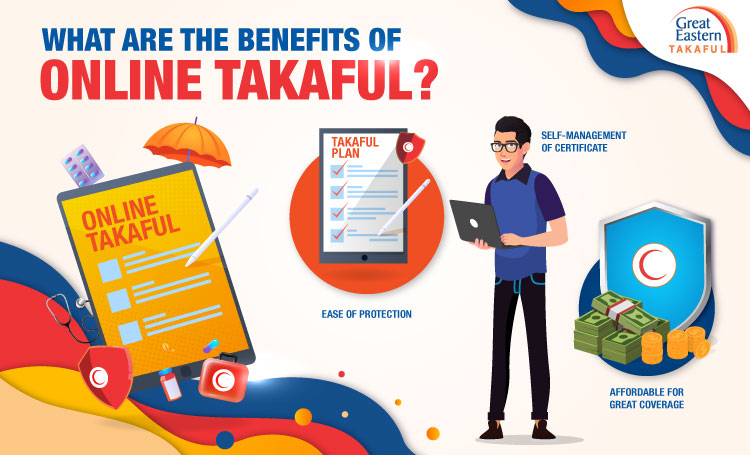

Benefits of online takaful

In this day and age, things have never been made easier. In fact, products get better, processes get faster, and services simplified. These days, people expect issues to be troubleshot quicker, with a shorter turnaround time. Find out the benefits of online takaful in the advent of digitalisation.

Benefits of online Takaful

In this day and age, things have never been made easier. In fact, products get better, processes get faster, and services simplified. These days, people expect issues to be troubleshot quicker, with a shorter turnaround time. Why is this so? It can be summed up in one word: Digitalisation.

This has brought upon plenty developments in the financial industry in general. Take for example the movement towards financial management mobile applications (“apps”), whether they be apps for budgeting or financial tracking. Even banks have developed apps to simplify bank transactions.

Did you know that the Takaful industry in Malaysia has also taken up some digitalised initiatives in the recent years? Aside from having processes streamlined and managed via systems and computers, Takaful plans can now be subscribed to online too!

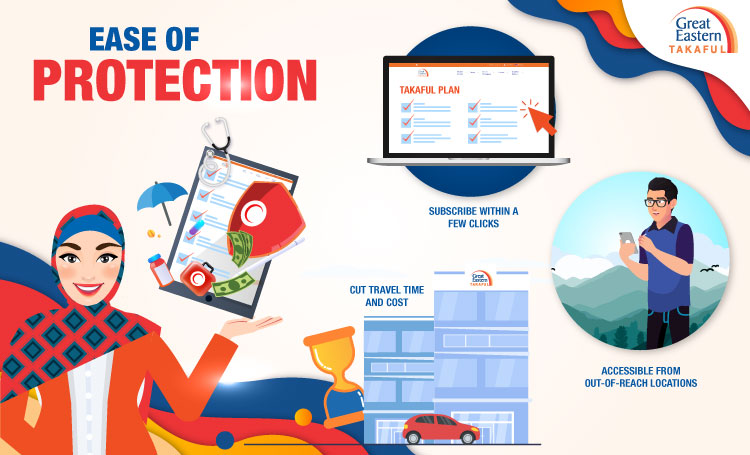

Ease of protection

The first benefit is that online Takaful provides an ease of protection. Gone are the days when the only way to subscribing to a Takaful plan is through a Takaful operator or its agents. With online Takaful, you no longer need to meet an agent face-to-face or go to the nearest Takaful operator office. In fact, you can subscribe to a plan on the computer or mobile phone within a few clicks.

Not only does online Takaful help cut travel time and cost, it makes Takaful very accessible to those who are located in harder to reach places – so long as an Internet connection is present. All one has to do to subscribe to a plan is to head to a Takaful operator’s website, select the desired plan for a quote, fill up details, complete a declaration form, and make the payment on the site itself. Usually an email will be sent from the Takaful operator to indicate the confirmation of the plan subscription. You can also subscribe to various online Takaful plans via third party apps such as Boost and Shopee which you can also enjoy other rewards as a member.

Self-management of certificate

Have you recently changed your home address and need to update your Takaful details?

Thinking of appointing a beneficiary for your Takaful certificate?

Furthermore, with an online Takaful, you will also be able to manage your certificate(s) single-handedly by yourself without an intermediary for service requests such as shown above. All that is made possible online – and yes, this also includes claims! By managing your Takaful certificate online, there is no need to reach out to a Takaful agent. This means that there would be little to no waiting time for changes to be made to your certificate. You may choose to carry out such services in your own convenience, practically anytime, anywhere.

Being able to manage your own certificate also allows for accuracy, as you being the service requestor, will have some form of control in making changes to your certificate to your heart’s desire. With online Takaful, it is all about customer empowerment – about enabling you as a customer to not only decide the changes to be made, but to make those changes happen too. Online certificate management is also made available for non-online plans for those who prefer to make changes on their own. Sound like you?

Affordable For Great Coverage

Online Takaful plans are known to be affordable. This is due to the non-utilisation of agents, of which is usually taken into consideration when pricing a Takaful product. Everybody likes an affordable option. However, there are times when people think “affordable” is synonymous to a lack of quality. This could not be any more wrong!

Online Takaful plan contributions are usually priced based on age; so if you are young, this might be your golden opportunity. Either way, young or not-so-young, you can be assured of a good basic coverage, depending on your needs and phase of life, at a contribution that is able to help your pocket stretch a little further.

In Conclusion

Online Takaful has its benefits, and can prove to be a lean, mean coverage machine for those seeking protection that is simple to subscribe to, easy to manage and friendly to the pocket. Takaful has never been made simpler – well, except maybe in the future.

Just follow these four easy steps:

Step 1: Get a quote

- Fill in the personal details of the person to be covered.

- Pick the coverage amount and payment frequency.

- Receive the Product Disclosure Sheet and confirm that you understand the term and conditions.

Step 2: Apply for a plan

- Fill in your personal details

- Fill in your occupation details

- Answer a Questionnaire

- Upload the supporting documents

- Review the application

- Nominate the beneficiary

Step 3: Declaration

- Fill in the declaration form

Step 4: Make the payment

Simple enough? Check out some online Takaful products here.

Or perhaps this has reminded you to update some of your certificate details. If so, head over to the i-Get In Touch (iGIT) portal here to do so.