Key benefits

-

Maturity Booster Benefit

Upon maturity of this plan, a percentage of total Annualised Basic Contribution may be payable from Takaful Operator's fund as a form of Hibah. This benefit is payable if the contribution is paid up to date, where all contribution due (if any) needs to be settled not later than twelve (12) months after the last contribution payment term.

Coverage Term Contribution Payment Term % Annualised Basic Contribution 10 Years 3 Pay 80% 15 Years 5 Pay 95% 20 Years 10 Pay 300% 25 Years 10 Pay 330% 30 Years 20 Pay 400% -

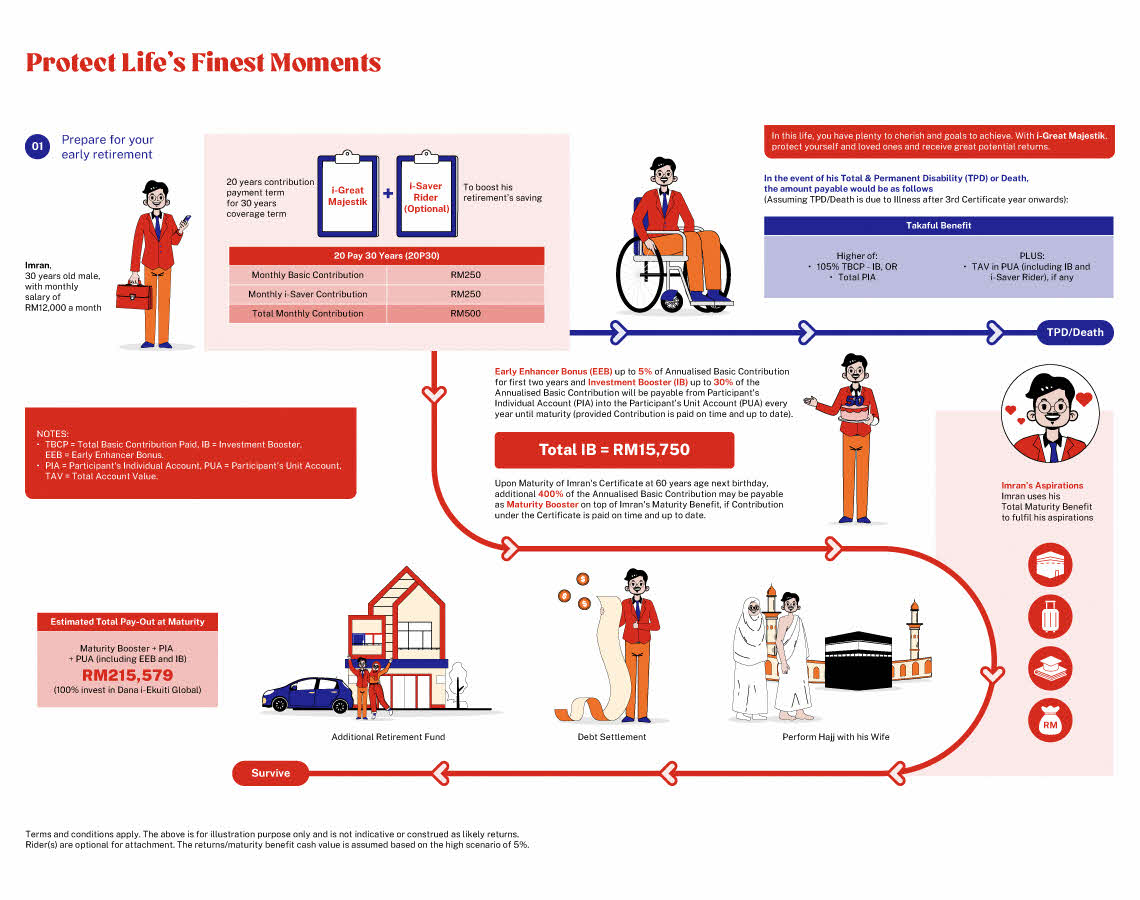

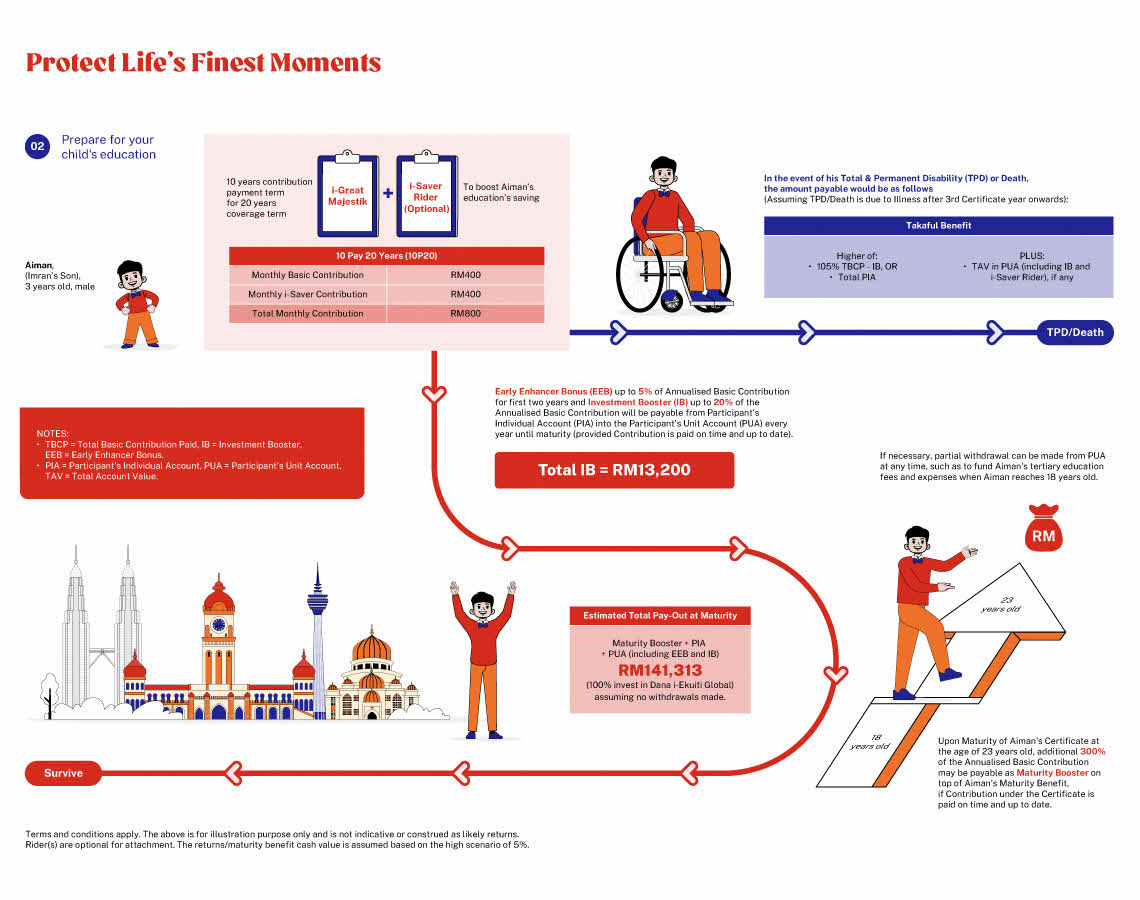

Investment Booster Benefit

Upon survival of the Person Covered, a percentage of the Annualised Basic Contribution will be payable from Participant's Individual Account into the Participant’s Unit Account towards the purchase of units in accordance with the fund direction chosen based on 100% allocation rate according to the schedule below starting from the end of the 1st Certificate Year annually until termination or maturity of the certificate, whichever occurs first.

Payment & Coverage Term Certificate Years 3 Pay 10 5 pay 15 10 pay 20 10 pay 25 20 pay 30 Years 1 - 5 5% 5% 5% 5% 5% Years 6 - 10 10% 10% 10% 10% 10% Years 11 - 25 - 20% 20% 20% 20% Years 26 - 30 - - - - 30% This benefit will only be payable if the Contribution under the certificate is paid on time and up to date.

In the event that the amount in PIA is insufficient to pay for the Investment Booster as prescribed under the certificate, the shortfall will be payable from Tabarru’ Fund 2.

Missed Investment Booster (IB) will not be payable even if the Contribution is paid up to date subsequently. Subsequent IB is payable as long as the Contribution is paid up to date.

-

Additional Accidental Death Benefit

Upon accidental death of the Person Covered, a percentage of the Total Payout shall be payable from the Tabarru’ Fund 1, on top of the Death Benefit, as follows:

Accidental Death Benefit

Additional Accidental Death Benefit

(% of Total Payout)

Death due to Accident in Malaysia

100%

Death due to Accident (Public Conveyance) in Malaysia:

i. while traveling in a public conveyance; or

ii. while riding as a passenger in an elevator or in electric lift; or

iii. in consequence of the burning of any hotel or other public building (exclude theatre or cinema) in which the Person Covered shall be present at the time of commencement of the fire;

300%

Death due to Accident outside of Malaysia

300%

-

No Medical Underwriting

Get this protection plan without having to go through the hassle of medical underwriting.

-

Attachable Riders

Customise your Takaful plan for a comprehensive protection with these optional 3 riders:

i-Saver Rider

95% of contributions payable will be allocated into the Participant’s Unit Account for savings and investment purposes.

i-Provider Critical Illness Term Rider

Provides future contribution in the event of Person Covered diagnosed with one of the critical illnesses except angioplasty and other invasive treatments for coronary artery disease.

i-Contributor Protection Plus Term Rider

Provides future contribution in the event of Contributor's death, Total & Permanent Disability or diagnosed with one of the critical illnesses except angioplasty and other invasive treatments for coronary artery disease.

How i-Great Majestik works

Let us match you with a qualified Takaful advisor

Our Takaful advisor will answer any questions you may have about our products and planning.

How can we help you?

Understand the details before participating

1. i-Great Majestik is a Family Term Takaful Plan with combination of Takaful Protection (Traditional Takaful Component) and Optional Saver and distributed Investment Booster (Investment-Linked Takaful Component) that provides coverage upon Death or Total Permanent Disability of the Person Covered. The investment-linked Takaful component is tied to the performance of the underlying assets, and is not a pure investment product such as unit trusts.

2. Age refers to age next birthday. Contributions are payable following the contribution payment term or upon death or Total & Permanent Disability of the Person Covered, or termination of the certificate, whichever occurs first.

3. You may stop paying contributions and still enjoy protection as long as there are sufficient amount of money in the Participant’s Individual Account to pay for the Tabarru' and Contribution Holiday fees, where applicable. However, there is a possibility of certificate lapsing when the required charges, including Tabarru' and Contribution Holiday fees, exceed the money available in Participant’s Individual Account and Participant’s Unit Account.

4. You should be convinced that this plan will best serve your needs and that the contributions payable under the Certificate are affordable to you.

5. A “Free-Look Period” of 15 days from the delivery of the Certificate is given for you to review the suitability of the plan. If the Certificate is returned to us during this period, we shall refund an amount equal to the sum of:

i. total Takaful Contribution (if any), and

ii. total values in Participant’s Unit Account (if any) of this Certificate, and

iii. any Upfront Charge which have been deducted from Participant’s Unit Account of this Certificate; (if any).

6. You may receive the Cash Value in Participant’s Individual Account (if any) and Total Values in the Participant’s Unit Account (if any) upon termination or maturity of this plan, which may be less than the total allocated contribution into the Participant’s Individual Account and Participant’s Unit Account. You also may receive Early Enhancer Bonus Benefit and Maturity Booster Benefit (if any). No benefits will be payable from the Tabarru’ Fund 1 upon termination or maturity.

7. The Participant’s Individual Account and Participant’s Unit Account will be based on the actual performance of the funds and is not guaranteed. The investment risks under this plan will be borne solely by you and both the Participant’s Individual Account and Participant’s Unit Account may be less than the total contributions contributed to the fund(s). Depending on the fund's performance, the Certificate value may decrease. There is a possibility of Certificate lapsing when the required charges (including Tabarru' and Contribution Holiday Fees) exceed the total value of the Participant’s Individual Account available. The sustainability of the plan depends on the performance of the underlying fund(s).

8. Participating in a Family Takaful plan is a long-term financial commitment. If you do not pay your contributions within the grace period of 30 days, your Certificate may lapse. The accumulated cash value that you may get upon cancellation of the Certificate before maturity period will be lesser than the total amount of contribution that you have paid.

9. If you switch your Certificate from one Takaful Operator to another or if you replace your current Certificate with another Certificate within the same Takaful Operator, you may be required to submit an application where the acceptance of your proposal will be subjected to the terms and conditions of switching or replacement.

This brochure merely provides general information only and is not a contract of Family Takaful. You are advised to refer to the Benefit Illustration, Product Disclosure Sheet and sample Certificate for detailed features and benefits of the plan before participating in the plan. For further information on the investment-linked funds, please refer to the Fund Fact Sheets.

i-Great Majestik is a Shariah-compliant product.

If there is a discrepancy between the English and Malay versions of this brochure, the English version shall prevail.

Great Eastern Takaful Berhad is a member of PIDM.

The benefit(s) payable under eligible certificate/product is (are) protected by Perbadanan Insurans Deposit Malaysia (PIDM) up to limits. PROTECTION BY PIDM ON BENEFITS PAYABLE FROM THE UNIT PORTION OF THIS CERTIFICATE/PRODUCT IS SUBJECT TO LIMITATIONS. Please refer to PIDM’s Takaful and Insurance Benefits Protection System (TIPS) Brochure or contact Great Eastern Takaful Berhad or PIDM (visit www.pidm.gov.my).