The Importance Of Family Medical Takaful

Wondering what makes family medical Takaful stand out compared to the more commonly-known personal medical Takaful? Read on to find out more.

Importance Of Family Medical Takaful

Many of us are aware of medical Takaful, that it helps to cover the medical and surgical expenses incurred at a hospital on an individual. Typically, it is one of the more well-known and well-received forms of protection among Malaysians as we want to be ensured we are cared for in times of illness and medical emergencies. In reality, with rising medical costs that we read about in the news, we know it is getting more difficult to fully pay for things on our own. So, we find the best ways to better protect our financials by participating in medical Takaful.

Knowing about medical Takaful as individuals, family medical Takaful exists in the market too! Wondering what makes family medical Takaful stand out compared to the more commonly-known personal medical Takaful? Read on to find out more.

Medical Protection For All

You may be thinking this already:

“I am covered by my personal medical Takaful. Why would I also need to participate in a family medical Takaful?”

Perhaps you are going through some big changes in your life. For instance, are you married, or soon to get married? Are you thinking of starting a family, or do you already have a little family of your own? If you have answered yes to any of those, a family medical Takaful could be right up your alley.

When you are newly married, you realise you have another person to look after, a dependent. As your family grows, you will have more dependents under your care. Naturally, you would want to ensure there is enough financial means to support your family’s livelihood in any unfortunate event that would happen to you or them. Participating in a family medical Takaful enables your family to get the adequate medical protection. This way, you can rest assured that your spouse and child(ren) are covered in times of illness and/or medical emergencies.

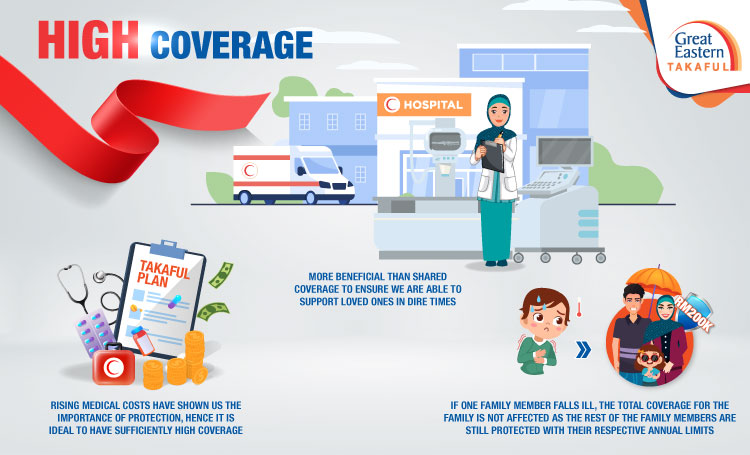

High Coverage

The other important thing when it comes to family medical Takaful is the coverage amount. With anything to do with hospital visits, treatments and medical bills, we always like to ensure we have some form of financial cushioning to help us through those times.

Rising medical costs have shown us the importance of protection, hence it is ideal to have sufficiently high coverage. When each family member enrols in a family medical Takaful, the annual limit is not shared. That means if one family member falls ill, the total coverage for the family is not affected as the rest of the family members are still protected with their respective annual limits.

This would be far more beneficial than a shared coverage and will ensure we would be able to support our loved ones in the event of treatment for illnesses short-term or long-term, hospital visits, surgeries, et cetera. This would give you peace of mind, not to worry whilst working and caring for your loved ones in dire times.

Cost Effective

Medical Takaful is important, so it is a worthy investment to budget into your family expenses. However, you would soon realise that participating in an individual medical Takaful plan for every one of your family members can really put a strain in your pocket. This may ring especially true if you are the only breadwinner of the household; but even if you are not the only breadwinner, it may still be a stretch and there could be a risk of not being able to afford it, given the various financial commitments you would already have.

As it is with any Takaful protection, starting early could benefit you in the long run as the contributions may be cheaper compared to when you start later on in your family life. This however, may vary depending on the age of your child(ren). Regardless, they would also then grow up with the knowledge of Takaful protection. Therefore, participating in a family medical Takaful would attribute to great savings to you and your family. What helps even more is when a family discount is given for when you and your family member(s) participate.

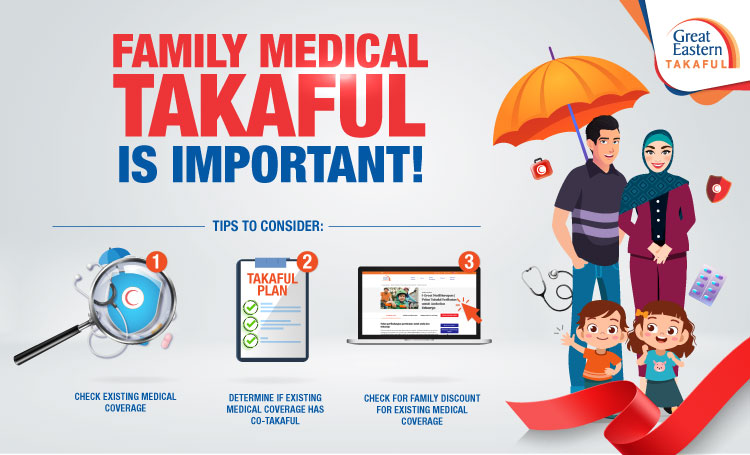

Tips To Consider

Aside from a personal medical Takaful, family medical Takaful is important to have especially if you are in the beginning phases of starting a family. It would be far more beneficial as we have learned so far.

Considering participating in a family medical Takaful, but not sure where to start? Here are some tips for you!

First, check your existing medical coverage. It is advised that you periodically check your existing coverage plans to ensure you are well protected, given the changes in your life stage. This is so you can adjust according to your needs and goals. It helps to look into the benefits provided (i.e. hospitalisation, surgery, etc.).

Next, you would want to determine if the existing medical coverage has co-Takaful. If co-Takaful is involved, there is a need for you to pay a certain amount from the total medical bill. This means having to share the cost between yourself and the Takaful Operator.

Lastly, does your existing family medical Takaful offer you a family discount? Having learnt that participating in a family medical Takaful provides great value for you and your family, you can actually save more. With a growing family, every cent counts!

If you would to have a further look, we offer a comprehensive family medical takaful protection plan with a family discount.