What is infectious disease & why do you need an infectious diseases protection?

Find out why you need infectious diseases protection and how it will benefit you.

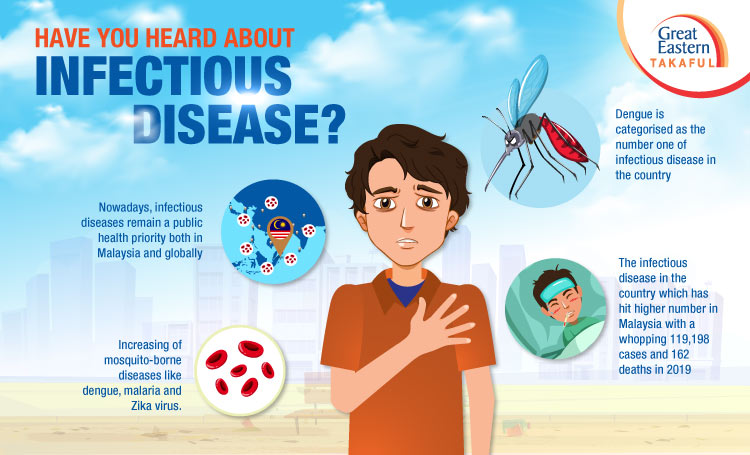

Have you heard about infectious disease?

Nowadays, infectious diseases remain a public health priority both in Malaysia and globally. Many diverse problems posed to healthcare systems from infectious diseases including the increasing of mosquito-borne diseases like dengue, malaria and Zika virus.

Do you know why infectious diseases like these become a priority to our country?

According to the Disease Control Division of the Ministry of Health statistics, dengue is categorised as the number one of infectious disease in the country which has hit higher number in Malaysia with a whopping 119,198 cases and 162 deaths in 2019. It was a worrying number of cases in Malaysia. This number has made Malaysia realise how important it is to get protected not only for the major incidents in life but also against infectious diseases especially when we are now living in the endemic era due to Covid-19.

Let’s find out why you need infectious diseases protection and how it will benefit you.

What is infectious diseases protection?

Most of the Takaful Operator exclude claims related to infectious diseases in their health protection plan. It is most probably due to low demand and lack of awareness about the importance of getting an infectious diseases protection. Some of us may think that existing protection plan are enough to protect them from any unfortunate events. Unfortunately, misfortunes can happen to you when you least expect it.

Before you decided to subscribe to an infectious diseases protection, the first thing you need to fully understand is how the plan works, its coverage and benefits. Remember, you not only need to understand about this protection, but you also need to understand the coverage and benefits about other protection as well. Only then, you will be able to know which one of the protections that really suits you.

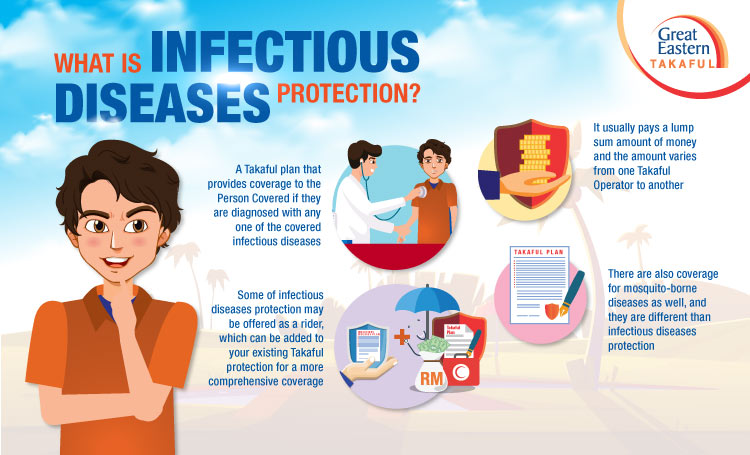

Let’s now talk about infectious diseases. What is infectious diseases protection? Infectious diseases protection is a Takaful plan that provides coverage to the Person Covered if they are diagnosed with any one of the covered infectious diseases. The infectious diseases protection may be offered as a rider, which can be added to your existing Takaful protection for a more comprehensive coverage. It usually pays a lump sum amount of money and the amount varies from one Takaful Operator to another. There are also coverage for mosquito-borne diseases as well, and they are different than infectious diseases protection. Before settling on an infectious diseases protection plan, it is important to find out what kind of coverage and benefits it provide.

Please make sure that you choose the right one that gives both infectious diseases and mosquito-borne diseases coverage like the one offered by Great Eastern Takaful.

What are the benefits of infectious diseases protection?

Afflicting with a disease is no laughing matter. What will happen if it’s an infectious disease with high rate of contagion? It does not only affect one’s physical and emotional being but it will also leave a significant impact on one’s financial consequently. For instance, contracting dengue often requires hospitalisation. The recovery process is painstakingly slow and may take around two weeks generally. What’s worse if it gets more severe which requires ventilation and longer time to recover. In this unfortunate event, the question you need to ask yourself is will this cause financial difficulty to you and your family?

By having an Infectious Diseases protection, you don’t need to worry about that. You may use the benefits you received to pay the hospitalisation and treatment costs. You may focus on your recovery without worrying about potentially high medical bills that you need to pay. Moreover, the benefit received may also be used to purchase medical equipment or alternative treatment that would help with your recovery process. Apart from that, the benefits received will definitely come in handy as it can be used to replace the income you may have lost temporarily due to hospitalisation. It would certainly help you and your loved ones to fulfil your existing monthly commitment, so your family can continue living without being impacted financially.

Imagine what would happen to your loved ones if you do not have enough protection.

Your future depends on you, not anyone else!

In conclusion, getting an infectious diseases protection plan is essential, especially at times like this where contagious virus spread rapidly. Before finalising which infectious diseases protection plan you are participating, make sure you understand the coverage and payout it provides. You have to find out what are the diseases being covered in the plan and what are the exclusions. It’s best to get a more comprehensive coverage that provides protection for both Infectious Diseases and Mosquito-Borne Diseases like the one Great Eastern Takaful offers. With an affordable price of these 2 plans, you will get the best of both worlds.

There are various of Takaful protection plan you can get from Great Eastern Takaful that would benefit you. However, the best protection plan is the one that provides a comprehensive coverage that benefits you and your loved ones in the future. Do not be afraid to make changes in your life before you regret it later. Your future depends on you, not anyone else!