Key benefits

-

Simplified underwriting

Get this plan with hassle-free application

-

Bereavement Allowance

In the event of death, your family will receive RM5,000 from the Death Benefit in advance to assist with the funeral expenses.

-

Basic Sum Coverage of up to RM500,000

Choose your coverage amount starting at RM100,000 and up to RM500,000 for death or Total Permanent Disability (TPD) Benefit to protect your loved ones against financial difficulty.

-

Underwriting surplus and investment profit

You are entitled to the underwriting surplus and investment profit, if any, under this plan. The underwriting surplus and investment profit will be payable to you via any medium that the Takaful Operator deemed fit.

Note: The underwriting surplus and investment profit are determined yearly.

How i-Great Murni 2.0 works

Your questions answered

- Yes, you can. However, each individual is subject to the overall Basic Sum Covered limit of RM500,000.

- Upfront Charge (Wakalah Fee)

o Upfront Charge is the amount deducted from the Tabarru' Fund (as a percentage of contribution paid less service tax and/or other taxes), which consists of

§ the direct distribution cost, and

§ the management expenses for administration of your certificate, including stamp duty of RM10

Upfront Charge for i-Great Murni 2.0 is 10% of the contribution paid.

- Tabarru’

o Tabarru’ (the remaining contribution paid after the upfront charge), will be channelled to Tabarru’ Fund based on the mode of payment selected at the beginning of each contribution due.

- The benefits of online takaful Malaysia are that it includes the convenience of self-managing your certificate, with minimal to no waiting time for making changes, eliminating the need for an intermediary. Furthermore, online Takaful plans tend to be affordable due to the absence of agent fees, which are typically factored into the pricing of traditional Takaful products.

- This plan is eligible for those who are between 19 and 60 years of age next birthday

Let us match you with a qualified Takaful advisor

Our Takaful advisor will answer any questions you may have about our products and planning.

How can we help you?

Understand the details before participating

Great Eastern Takaful Berhad (916257-H) is licensed under the Islamic Financial Services Act 2013 and is regulated by Bank Negara Malaysia. No intermediaries are involved in the promotion or marketing of products offered through direct channel.

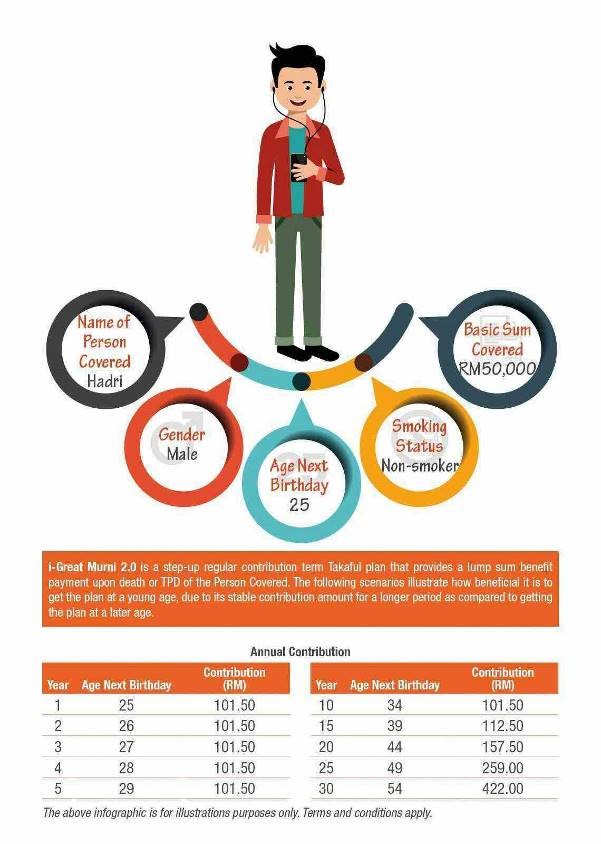

- i-Great Murni 2.0 is a Family Takaful with step-up regular contribution term. You should be convinced that this plan will best serve your needs and that the contributions payable under the certificate are affordable by you.

- Upon surrender, you should not expect to receive any value from the certificate. Nevertheless, the unexpired Tabarru' from the Tabarru' Fund and the unearned, unallocated contribution from the Takaful Operator’s fund (if any) will be payable to you.

- A Free-Look Period of 15 days from the delivery date of the certificate is given for you to review the suitability of this plan. If the certificate is returned to the Takaful Operator during this period, the Takaful Operator shall refund an amount equal to the amount of contributions paid.

- You should continue to pay your contributions regularly until your plan reaches maturity so that you can enjoy continuous protection. Failure to do so may result in coverage termination before its time.

- If you switch over your certificate from one Takaful Operator to another or if you replace your current certificate with another certificate within the same Takaful Operator, you may be required to submit an application where the acceptance of your proposal will be subjected to terms and conditions to be imposed at the time of switching or replacement.

This information is for general information only. You are advised to refer to the brochure, Product Disclosure Sheet and sample of certificate for detailed features and benefits of the plan before participating in the plan.

Great Eastern Takaful Berhad is a member of PIDM. The benefit(s) payable under eligible certificate/product is(are) protected by PIDM up to limits. Please refer to PIDM’s TIPS Brochure or contact Great Eastern Takaful Berhad or PIDM (visit www.pidm.gov.my).