12 January - 31 January 2025

Participate in this plan during the #TooMajestik Campaign to enjoy the benefits below:

- Payment Term of 3 years with 10 years coverage term

or

- Enjoy a minimum contribution with RM150 monthly for 20 years or RM300 monthly with 10 years

| Contribution Payment Term | Minimum Annual Contribution |

| 10 Years | RM3,600 |

| 20 Years | RM1,800 |

Don't miss the opportunity to protect your future while enjoying these exclusive rewards. Download the brochure here.

Key benefits

-

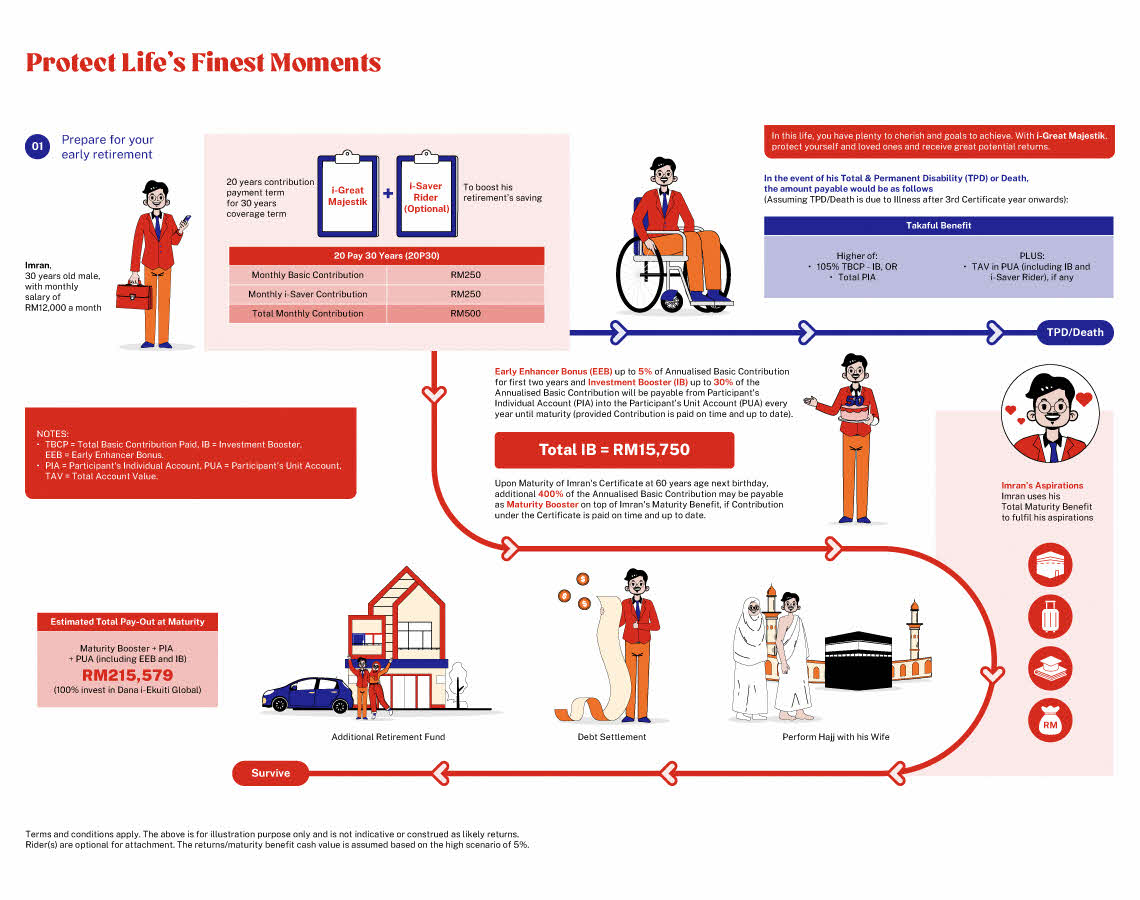

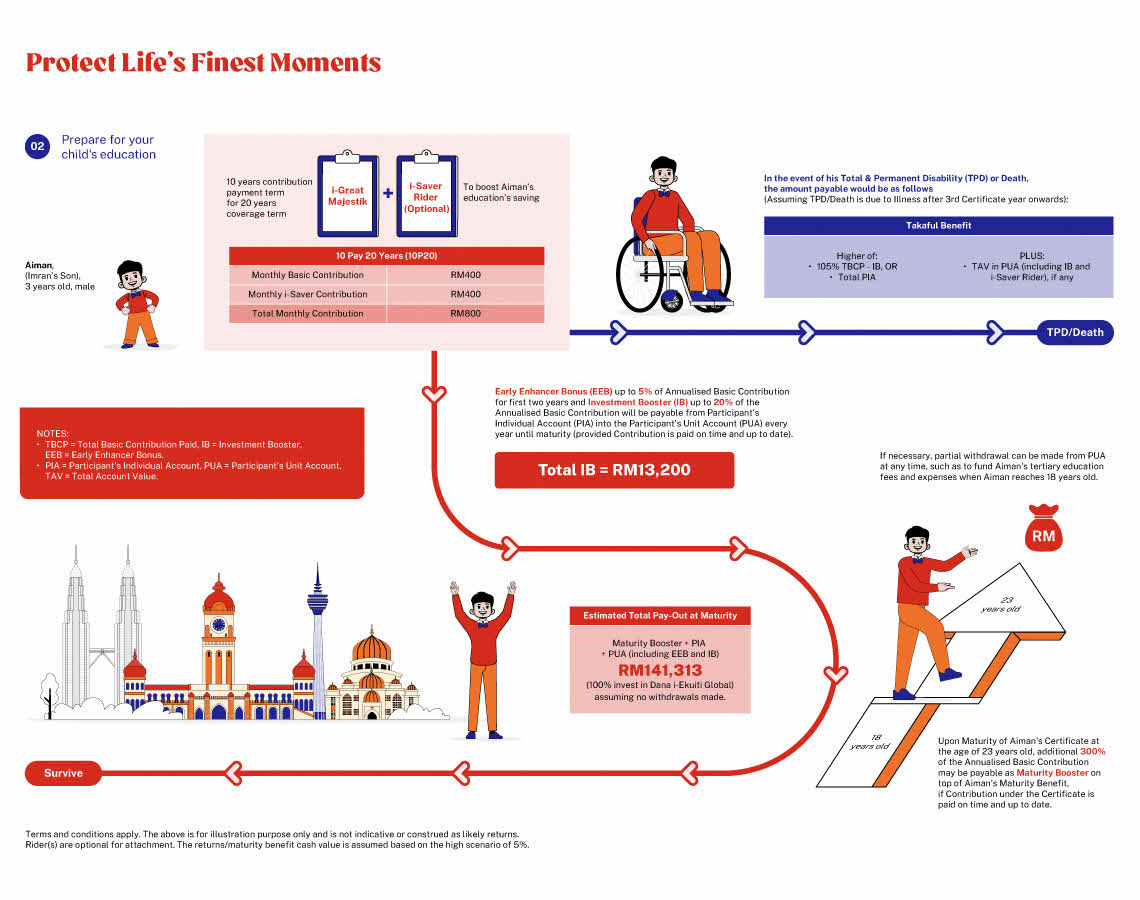

Maturity Booster Benefit

Upon maturity of this plan, a percentage of total Annualised Basic Contribution may be payable from Takaful Operator's fund as a form of Hibah. This benefit is payable if the contribution is paid up to date, where all contribution due (if any) needs to be settled not later than twelve (12) months after the last contribution payment term.

Coverage Term Contribution Payment Term % Annualised Basic Contribution 10 Years 3 Pay 80% 15 Years 5 Pay 95% 20 Years 10 Pay 300% 25 Years 10 Pay 330% 30 Years 20 Pay 400% -

Investment Booster Benefit

Upon survival of the Person Covered, a percentage of the Annualised Basic Contribution will be payable from Participant's Individual Account into the Participant’s Unit Account towards the purchase of units in accordance with the fund direction chosen based on 100% allocation rate according to the schedule below starting from the end of the 1st Certificate Year annually until termination or maturity of the certificate, whichever occurs first.

Payment & Coverage Term Certificate Years 3 Pay 10 5 pay 15 10 pay 20 10 pay 25 20 pay 30 Years 1 - 5 5% 5% 5% 5% 5% Years 6 - 10 10% 10% 10% 10% 10% Years 11 - 25 - 20% 20% 20% 20% Years 26 - 30 - - - - 30% This benefit will only be payable if the Contribution under the certificate is paid on time and up to date.

In the event that the amount in PIA is insufficient to pay for the Investment Booster as prescribed under the certificate, the shortfall will be payable from Tabarru’ Fund 2.

Missed Investment Booster (IB) will not be payable even if the Contribution is paid up to date subsequently. Subsequent IB is payable as long as the Contribution is paid up to date.

-

Additional Accidental Death Benefit

Upon accidental death of the Person Covered, a percentage of the Total Payout shall be payable from the Tabarru’ Fund 1, on top of the Death Benefit, as follows:

Accidental Death Benefit

Additional Accidental Death Benefit

(% of Total Payout)

Death due to Accident in Malaysia

100%

Death due to Accident (Public Conveyance) in Malaysia:

i. while traveling in a public conveyance; or

ii. while riding as a passenger in an elevator or in electric lift; or

iii. in consequence of the burning of any hotel or other public building (exclude theatre or cinema) in which the Person Covered shall be present at the time of commencement of the fire;

300%

Death due to Accident outside of Malaysia

300%

-

No Medical Underwriting

Get this protection plan without having to go through the hassle of medical underwriting.

-

Attachable Riders

Customise your Takaful plan for a comprehensive protection with these optional 3 riders:

i-Saver Rider

95% of contributions payable will be allocated into the Participant’s Unit Account for savings and investment purposes.

i-Provider Critical Illness Term Rider

Provides future contribution in the event of Person Covered diagnosed with one of the critical illnesses except angioplasty and other invasive treatments for coronary artery disease.

i-Contributor Protection Plus Term Rider

Provides future contribution in the event of Contributor's death, Total & Permanent Disability or diagnosed with one of the critical illnesses except angioplasty and other invasive treatments for coronary artery disease.

How It Works

The benefit(s) payable under eligible certificate/product is (are) protected by Perbadanan Insurans Deposit Malaysia (PIDM) up to limits. Please refer to PIDM’s Takaful and Insurance Benefits Protection System (TIPS) Brochure or contact Great Eastern Takaful Berhad or PIDM (visit www.pidm.gov.my).