How to claim Takaful death benefit

Death claim is a Takaful term plan that provides a lump sum payment to the beneficiary upon the covered person's death. Learn more here.

What is a death claim?

A typical death claim is a request for payment made by the beneficiaries of a life insurance certificate after the insured person has passed on. According to the death claim insurance certificate, when a life insurance certificate holder dies, the insurance company is required to pay out a death benefit to the designated beneficiaries of the certificate.

A Takaful death claim, on the other hand, is a request for payment made by the beneficiaries of a Takaful certificate after the death of the certificate holder. When a Takaful participant dies, designated beneficiaries of the certificate are to make a claim after death and the Takaful operator is required to pay out a death benefit to them.

However, unlike conventional life insurance, where the insurer invests the premiums paid by the certificate holders and pays out the claims from the accumulated pool, Takaful operates on the principle of Tabarru’. This means that the certificate holders contribute a certain amount of money into a common pool, which is then used to pay claims when they arise.

Who can claim the death benefit?

The beneficiaries of a Takaful certificate are the ones who can make a death claim. The beneficiaries are those who are designated by the certificate holder to receive the death benefit in the event of the certificate holder's death. One or more beneficiaries can be named as the receiver in their certificate, and can also specify the percentage of the death benefit that each person will receive.

Documents required for death claim

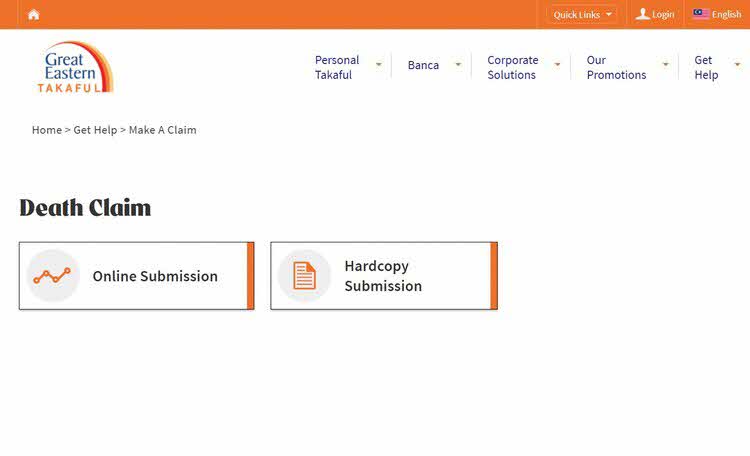

In the event that you need to make a death claim through Great Eastern Takaful Berhad, you have the option to make a claim online or through hardcopy submission.

If you decide on making a claim online, you would first need to submit the following documents for the type of claim you are making. The documents are:

- Death Claim Form

- Doctor Statement

- Accidental Death Benefits Claim

- Letter of Authorisation/Consent

- Bereavement/Compassionate Benefit Claim Form

- Notification of Death Claim

- Family Claims - Document Checklist

- Direct Credit Facility Form

After you have gathered the necessary documents, you can then submit them via i-Get In Touch (iGIT) or through your Great Eastern Takaful Advisors. If you want to submit the forms via i-Get In Touch, you can refer to Claim Form Submission Guide (PDF Guide) and Claim Submission (Video Guide) for a detailed guide on how to go about submitting the documents.

If you decide on submitting your hardcopy claim, the documents to prepare are the same as the ones to provide for an online submission. You can submit your documents at the nearest Great Eastern Takaful Berhad branches or to our Customer Service Centre located at the Mezzanine floor at the Head Office.

You can check the status of your claims at a later time by using the ‘My Claim’ function in i-Get In Touch (iGIT).

Despite how difficult it is to bring up the topic of death, the deceased would have left behind a family who needs the death claim in order to manage. Learn more on Great Eastern Takaful Berhad's death claim procedure here.